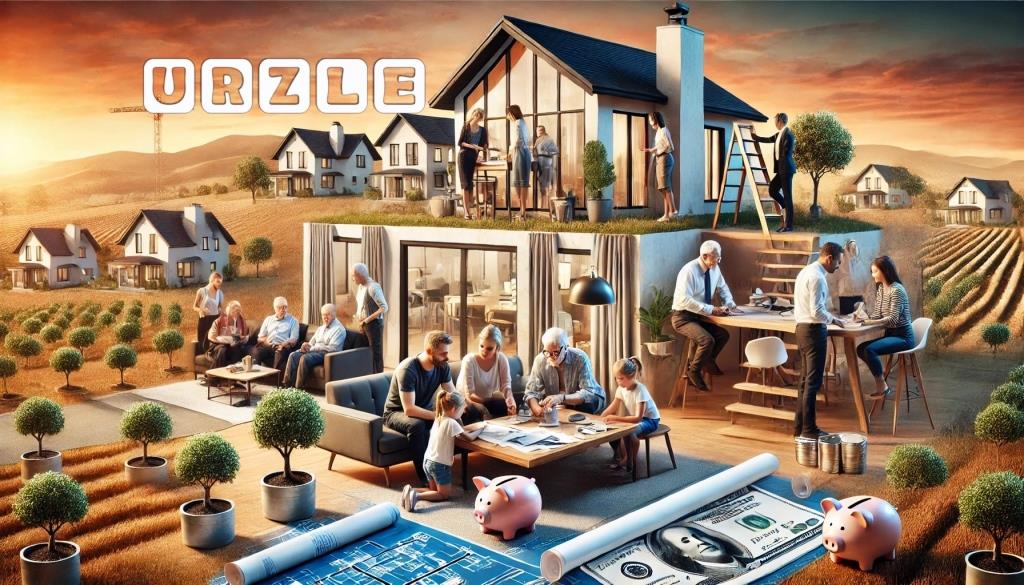

Building generational wealth is a goal that transcends individual prosperity. It’s about creating a financial legacy that benefits not only you but also your children, grandchildren, and beyond. Whether you’re a young professional, a single individual seeking financial security, or a married couple planning your family’s future, understanding and applying the principles of generational wealth is key to achieving long-term financial stability.

In this article, we’ll explore actionable strategies to help you build generational wealth, focusing on practical advice, relatable examples, and steps you can take today.

1. Real Estate Investment as an Asset: Exploring Property Investments for Building a Family Legacy

Why Real Estate?

Real estate is one of the most reliable avenues for building and transferring generational wealth. Properties tend to appreciate over time, and rental income can provide steady cash flow.

Practical Advice:

- Start Small: If you’re new to real estate, begin with a single rental property or consider house-hacking (renting out part of your home).

- Location Matters: Invest in areas with growth potential, such as cities experiencing economic development or neighbourhoods with improving amenities.

- Diversify: Balance residential properties with commercial investments to spread risk.

- Leverage Financing Wisely: Use low-interest loans to acquire properties, but avoid over-leveraging to ensure sustainability.

Real-World Example:

Olivia, a single 30-year-old, purchased her first duplex with an FHA loan, living in one unit while renting the other. Within five years, she had accumulated enough savings from rental income to purchase two more properties. By her early 40s, her real estate portfolio was generating passive income, allowing her to leave her 9-to-5 job and focus on her family.

Action Steps:

- Research real estate investment basics and consider starting with a small property.

- Set aside a portion of your income for a down payment.

- Consult with a real estate advisor or mentor to understand market trends.

2. Understanding Inheritance and Trusts: How They Work and Their Benefits for Transferring Wealth

Why Use Trusts and Inheritance Planning?

Trusts and inheritance planning ensure your wealth is distributed according to your wishes while minimizing taxes and family disputes.

Practical Advice:

- Create a Trust: A trust allows you to designate how your assets will be managed and distributed. It can also protect your heirs from creditors or mismanagement.

- Minimize Taxes: Estate taxes can deplete generational wealth. Trusts and gifting strategies can reduce tax burdens.

- Appoint a Reliable Trustee: Choose someone who understands your financial vision and will execute your wishes faithfully.

- Educate Your Beneficiaries: Help your heirs understand the responsibilities and benefits of inherited wealth.

Real-World Example:

James and Emily, a married couple in their 40s, established a family trust to manage their real estate properties and investments. By involving their teenage children in the planning process, they instilled a sense of responsibility while ensuring their wealth would support future generations without unnecessary taxation or mismanagement.

Action Steps:

- Meet with an estate planner to discuss your options for trusts and inheritance planning.

- Create a list of assets you wish to include in a trust.

- Communicate your plan to family members to ensure alignment.

3. Teaching Kids Financial Literacy: Preparing the Next Generation for a Secure Future

Why It’s Crucial

Without financial literacy, even substantial generational wealth can be squandered. Teaching children about money early equips them to manage and grow the wealth they inherit.

Practical Advice:

- Start Early: Teach kids basic concepts like saving, budgeting, and the value of money from an early age.

- Use Real-Life Examples: Encourage children to earn money through chores or small jobs and guide them in managing it.

- Introduce Investing: Use kid-friendly platforms like custodial accounts to teach about stocks and compound interest.

- Lead by Example: Demonstrate smart financial habits, such as budgeting, saving, and investing, to model responsible behaviour.

Real-World Example:

Sophia, a single mother, set up a savings account for her 10-year-old son and matched every dollar he saved. By the time he turned 18, he had saved $5,000, which he used to start investing. This hands-on approach taught him the importance of saving and investing early.

Action Steps:

- Open a savings account for your child and involve them in managing it.

- Teach them about needs versus wants through real-life scenarios.

- Consider setting up a custodial investment account to help them learn about investing.

4. Estate Planning 101: Basics of Wills, Power of Attorney, and Other Essential Documents

Why It’s Important

Without proper estate planning, your assets may not be distributed as you intend. Estate planning protects your legacy and ensures your family is cared for in your absence.

Practical Advice:

- Create a Will: A will is the cornerstone of estate planning, detailing how your assets should be divided.

- Set Up a Power of Attorney: Designate someone to manage your financial and medical decisions if you’re unable to do so.

- Establish Beneficiaries: Ensure all accounts, such as retirement funds and life insurance policies, have updated beneficiaries.

- Plan for Digital Assets: Include instructions for accessing digital accounts, such as social media, email, and online banking.

Real-World Example:

David, a young professional, lost his father unexpectedly. Because his father had no will, the family faced lengthy legal battles over his estate. Learning from this, David created a will and named his wife as his power of attorney, ensuring his family wouldn’t face the same challenges.

Action Steps:

- Draft a will, even if your assets are modest.

- Consult with an attorney to create comprehensive estate planning documents.

- Review and update your plan every few years or after major life events.

Final Thoughts

Building generational wealth isn’t an overnight process—it requires thoughtful planning, strategic investments, and a commitment to financial literacy. By focusing on real estate investments, understanding trusts and inheritance, teaching kids financial literacy, and establishing comprehensive estate plans, you can lay the groundwork for a lasting family legacy.

Whether you’re single, a young professional, or part of a growing family, now is the time to take action. By making smart financial decisions today, you can create a brighter future for the generations to come.

Your Next Steps:

- Choose one area to start with—be it real estate, financial literacy, or estate planning—and take your first step this week.

- Share this article with friends and family to start a conversation about generational wealth.

The legacy you leave begins with the decisions you make today!